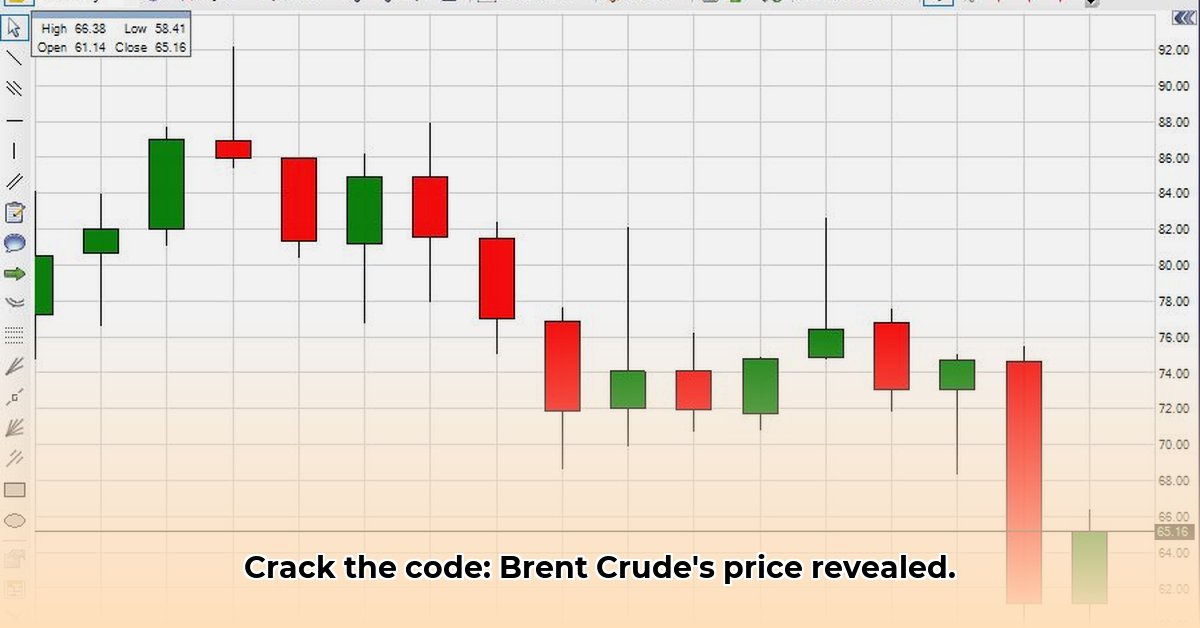

Brent Crude Oil Price Today: A Deep Dive

What's driving the current Brent Crude oil price? It's a complex interplay of global forces, making it crucial to understand the key factors influencing this vital commodity. This analysis provides a clear, data-driven perspective on the current market dynamics and potential future trajectories.

Is the current price accurately reflecting the underlying market fundamentals? Let's examine the critical factors at play. A shortage of readily available oil is pushing prices higher; demand from rapidly growing economies like China and India significantly contributes to this. However, this increased demand hasn't been met with sufficient investment in new oil extraction, creating a supply squeeze. Geopolitical instability – specifically in regions like the Middle East – also adds considerable uncertainty and volatility.

Understanding Brent Crude Oil Prices: Key Drivers

Several significant factors shape Brent Crude's price:

Global Geopolitical Landscape: Any instability in oil-producing regions, impacting supply chains (e.g., pipeline disruptions or sanctions), immediately reverberates across global markets, impacting supply and demand dynamics. Increased tensions almost always lead to price hikes.

OPEC+ Production Decisions: This cartel of oil-producing nations wields significant influence over global supply. Their output decisions directly affect prices; reduced production typically translates to higher prices.

Global Economic Health: A robust global economy usually translates to increased oil demand and therefore higher prices. Conversely, economic slowdowns or recessions reduce demand, leading to lower prices. This strong correlation is a key factor for investors.

US Dollar Strength: Since oil is priced in US dollars, a strengthening dollar increases the cost for buyers using other currencies, potentially influencing supply and demand.

Renewable Energy Transition: The growing prominence of renewable energy sources poses a long-term challenge to oil demand. As renewable energy technologies mature and become more cost-competitive, we expect a gradual decrease in oil consumption.

Brent Crude Price: Short-Term and Long-Term Outlook

Predicting future prices is inherently challenging. However, analysing current trends allows for informed assessments.

Short-Term (0-1 year): We anticipate continued price volatility, heavily influenced by geopolitical factors and ongoing supply constraints. Sudden surges in demand could lead to significant price increases.

Long-Term (3-5 years): The transition towards renewable energy will likely exert an increasing influence. Continued growth in renewable energy investment might gradually moderate oil demand growth, potentially putting downward pressure on long-term prices. However, considerable demand for oil, particularly in sectors such as manufacturing and transportation, is expected to persist for many years.

"The long term outlook is shaped by the interplay between persistent demand, particularly in emerging markets, and the steady integration of renewable energy sources," says Dr. Anya Petrova, Senior Economist at the Institute for Energy Economics.

Navigating the Market: Strategies for Different Stakeholders

Here's a breakdown of strategic approaches for various market participants:

| Stakeholder | Short-Term Strategy | Long-Term Strategy |

|---|---|---|

| Oil-Producing Countries | Optimize production efficiency; explore diverse revenue streams | Invest in new exploration, modernize infrastructure, enhance efficiency |

| Oil Refineries | Secure reliable oil supplies; utilize hedging to manage price risk | Adapt to shifting demands; explore alternative refining techniques |

| Energy Consumers | Plan for energy security; consider alternative energy solutions | Transition to renewables; improve energy efficiency; diversify sources |

| Investors | Diversify portfolios; employ risk management techniques; utilize hedging strategies | Consider long-term investments in renewable energy and energy-efficient technologies |

Risk Assessment and Mitigation

Several risks significantly impact Brent Crude prices:

| Risk Factor | Likelihood | Impact | Mitigation |

|---|---|---|---|

| Geopolitical Instability | High | High | Diversification; hedging strategies; robust risk assessment |

| Supply Chain Disruptions | Medium | Medium | Secure supply contracts; build resilient supply chains |

| Price Volatility | High | Medium | Utilize hedging strategies; sophisticated forecasting models |

| Regulatory Changes | Medium | Medium | Stay informed; adapt strategies proactively |

| Climate Change Policies | High | High | Transition to clean energy sources; embrace decarbonization |

Remember, understanding and actively managing these risks is crucial for success in the oil market. The increasing focus on environmental, social, and governance (ESG) factors will also play an increasingly important role in shaping the future of this global industry as sustainable options become more widely available.